Almost everyone who has lived in British Columbia during recent years has heard about the struggles of the lumber industry. This provokes the question: “How have things degenerated so much?” Theories about mismanagement, government tampering and NAFTA abound, and all are probably partially correct. For the past two-and-a-half decades, the Japanese economy and the B.C. lumber industry have been linked and it is no coincidence that they have slumped at the same time.

In the early 1970s, the B.C. forest industry began looking for a new market for its wood. Its market in the eastern United States was starting to dry up and it needed to find an alternative. Meanwhile, the Japanese government faced a problem. It did not think the Japanese lumber industry and its traditional building methods would be able to meet the needs of an expanding population. This mutual need set the stage for a beneficial partnership between British Columbian wood producers and Japanese homebuilders.

Although the Japanese market looked attractive, there were many hurdles to overcome. The first was adjusting to the differences in Japanese business philosophy which revolves around extensive quality testing, discussion by committee and building relationships. As a result, decisions were never made on the spot, but usually involved lots of discussion and many visits. Although changing philosophies was important, the main problem to overcome was the different building method used for the traditional Japanese house. The traditional Japanese house is a complex structure that requires a master carpenter on site at all times during construction. Green posts and beams are fastened together using detailed wooden joints. The carpenter must account for the shrinkage and twisting of the green wood as it dries over the course of building. This method is extremely time consuming and a carpenter can only build a few houses each year. In North America, on the other hand, houses are made using the platform frame construction (PFC) method. In this system, dimension lumber (2×4, 2×8, etc.) forms the frame, while plywood forms the walls, roof and floors. The PFC method is fast, simple and strong, and most of the wood is pre-cut before getting to the building site.

Although changing philosophies was important, the main problem to overcome was the different building method used for the traditional house.

Given the differences between building methods and the pressures of housing demands in Japan, the B.C. lumber industry recognized the potential of the PFC method in the Japanese market. So in 1973, the Council of Forest Industries (COFI), along with provincial and federal governments, began a market development program in Japan. The goal of this program was to introduce the PFC construction method to Japan and to emphasize the advantages of Canadian lumber. In 1974, in order to have a more direct contact with the market, COFI established an office in Tokyo. With the help of the federal government, four North American-style townhouses were constructed on the grounds of the Canadian Embassy. Since they were built on Canadian soil, they didn’t need to meet Japanese building codes. The event was well publicized and many tours were given during construction, including visits from government officials as well as builders and contractors. Shortly thereafter, Japan approved a new PFC building code.

Throughout the rest of the decade, a great deal of promotion was done to raise Japan’s PFC awareness: both sides undertook many trade missions, Canadian schools added training courses to accommodate members of the Japanese building industry, and builders constructed about a hundred demonstration houses. At last, the effort started to pay off, and in 1980, 13,000 PFC houses were built. This translated into over $200 million in lumber sales.

At the same time, the focus of the Japanese building industry shifted. Japanese builders decided the green lumber they were using was not reliable enough since it had a tendency to twist, split and shrink as it dried. In Japan, builders are responsible for their product for 20 years or more, and if any flaws develop, they must return to correct them. As they could avoid a lot of these flaws by using kiln-dried wood, builders began to insist on dry wood. This did not bode well for the B.C. coastal forest industry whose Hemlock and Cedar trees are very green and difficult to dry. Once again, the BC lumber industry was forced to change its strategy.

The PFC method is fast, simple and strong, and most of the wood is pre-cut before getting to the building site.

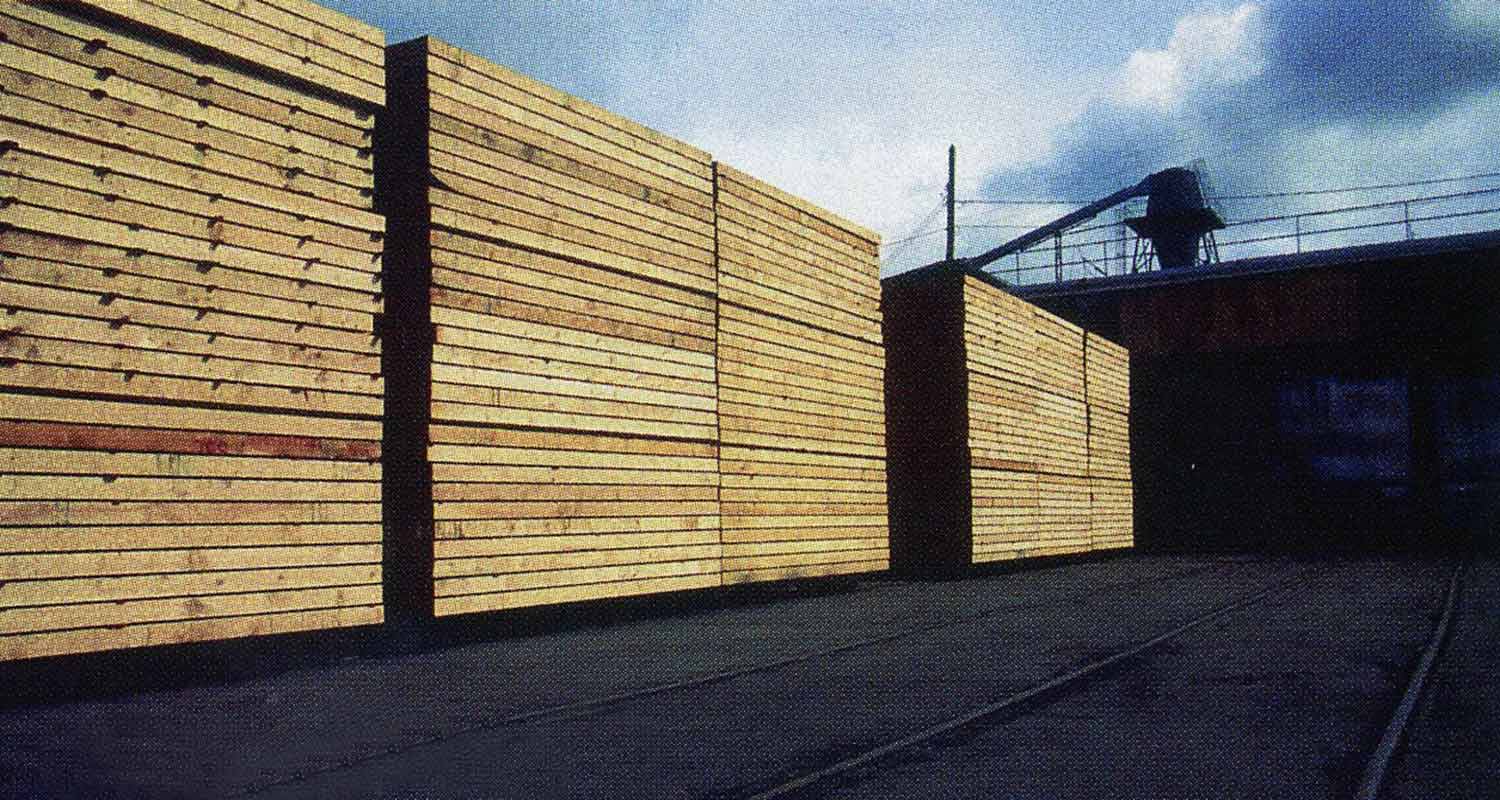

It was at this point that two changes occurred in the BC industry that still hold true today. First, B.C.’s interior mills entered the Japanese market. Their lumber, made primarily of spruce, pine and fir trees, is naturally very dry, sometimes not requiring drying at all. It is also lightweight and strong, and it does not split when nailed, making it ideal for the PFC method. The second change was that coastal mills, seeing that the market was now almost lost to them, shifted their production methods to focus on lumber for the traditional post and beam market. They made large investments in equipment and training to supply this market efficiently.

Today, coastal mills are experiencing major difficulties. Due to rising stumpage fees, labour costs and a new forest practices code, Canada’s coastal industry has the highest lumber cost in the world. With competition from the U.S. and an increased effort by Japan to develop its own domestic lumber industry, the Japanese market for the coastal mills is waning.

The situation is much more positive for interior mills. The number of PFC houses has seen a fairly steady increase. The strength and stability of the PFC design had been proven during the Kobe earthquake. In some areas, whole neighbourhoods were flattened leaving only some PFC houses standing. In 1996, there were almost 94,000 units built. This total dipped a little in 1997, but overall housing starts were lower as well.

The lumber industry in B.C. currently supports some 290, 000 jobs.

Japan’s economic downturn, while it has hurt the lumber industry, has not been entirely bad for BC. In fact, it has actually helped the industry maintain its market dominance. In the past, builders ordered large quantities on a quarterly basis. Recently, however, they have been switching to just-in-time ordering. In the just-in-time system, builders order what they need and it arrives right when they need it. Wood can leave an interior mill and arrive by ship in Japan just 12 days later, which is faster than any other source, save the Japanese domestic production.

For the moment, Japan and B.C. have a mutually beneficial relationship. The lumber industry in B.C. supports some 290,000 jobs directly and indirectly and the B.C. exports to Japan are worth more than $2 billion. With lumber that has been exported to Japan directly from B.C. being cheaper than Japan’s domestically produced lumber and through the use of PFC housing, Japan has managed to keep up with its increasing housing needs. Both sides hope that together they will enjoy a prosperous future so long as those needs continue to be met.